Read our Oanda review to find out if Oanda is really a safe broker. Discover what hides behind the perfect defense.

Expert OANDA Review

Oanda is chosen and trusted by many investors and traders around the world. It basically specializes in FX pairs for Forex and CFD traders. Thanks to brand awareness and recognition in many countries, the company quickly obtained popularity. Also, it offers in-depth market research to minimize the efforts of investors.

Key points to consider:

- The company is active since 1996. It is monitored within 6 tier-1 jurisdictions.

- Oanda is a low-risk online brokerage. It has plenty of expert market analysis instruments to offer. The service only falls behind such giants as IG and CMC Markets.

- The local platform for trading, fxTrade, is well-done though far from perfect. It guarantees perfect methods of algorithmic trading.

About the Company

The broker has made it through in more than twenty years. In 2001, OANDA became one of the first companies to offer an exclusive trading terminal to private traders. It opened access to trading with all popular instruments. OANDA is currently the largest global broker officially operating in five jurisdictions:

- USA, company OANDA Corporation, regulated by the National Futures Association (NFA No. 0325821);

- Canada, a company OANDA (Canada) Corporation ULC, regulated by the Investment Regulatory Organization of Canada (IIROC);

- Europe, a company OANDA Europe Limited, licensed and regulated by the UK Financial Conduct Authority (FCA), license number 542574;

- Asia Pacific, OANDA Asia Pacific Pte. Ltd. Regulated by the Monetary Authority of Singapore (License No. CMS100122-4) and International Trade Promotion Committee of Singapore (IE Singapore), Commercial Brokerage License No. OAP / CBL / 2012);

- Australia, OANDA Australia Pty Ltd. regulated by the Australian Securities and Investments Commission (ASIC), ABN 26 152 088 349, AFSL No. 412981.

By recognizing the language of the operating system and browser, the OANDA website immediately offers versions in multiple languages for traders around the globe. The website is done in a minimalistic style and contrasts sharply with the platforms of many financial companies. Finding the information you need is quite simple and it will not cause any difficulties even for a dummy. Even without registration, traders are offered many different tools for market analysis, which makes the process of making trading decisions convenient. Analytical reviews are published in English, which is not surprising since the bulk of clients are English-speaking. There are training materials available on the site, but they are also available only in English.

Sign-up Process

Residents of many countries except for the prohibited ones are invited to open an account in the English division of the company. To register your account with OANDA, you must complete the registration form. Even at the stage of registration, LCs are warned that your data may be transferred to the national tax authorities for tax purposes. It is necessary to upload documents confirming the identity and address of residence, indicate the source of income, and wait for the documents to be approved by the company managers.

Deposit and Withdrawal Approaches

Deposit and withdrawal operations depend on the company (payment system) you have an account with. OANDA Europe Limited customers can top up their balances by choosing bank transfers via SWIFT, payment debit/credit cards, PayPal, online transfer via Faster Payments, BACS, and CHAPS. Plenty of ways, right? The systems WebMoney and Qiwi that are so popular in the CIS are not available to clients. OANDA does not accept payments from third parties. Withdrawal of funds is possible only in the same way that the deposit was replenished. At OANDA Europe Ltd., cross-border withdrawal is prohibited. Funds received through bank transfer from the payer's country must be returned to the same country (country of funds’ origin).

There is no such thing as a minimum deposit in OANDA, you can transfer any amount to the account that allows you to maintain the required margin level for the selected instrument.

Trading Terms & Conditions

Due to different requirements of financial regulators, trading conditions differ markedly. The maximum leverage provided to American clients is 1:50. Customers are prohibited from hedging orders and must comply with the FIFO guidelines (e.g., all orders must be closed in the same sequence in which they were opened). The European division provides leverage from 1:30 on Majors to 1:10 on crosses

More than 90 currency pairs, as well as indices, commodities, bonds, and metals, are available for trading to the broker's clients. Additional fees are not charged. The spreads are quite competitive. For example, the spreads for EUR / USD and GBP / USD are 1.3 pips and 1.9 pips, respectively. Often, the minimum contract size for trading forex is one micro lot.

Trading Platforms

OANDA offers trading on its own platform, as well as the popular MT4 terminal to its clients. There are web versions of terminals for trading in any browser: from Chrome to Safari. Different versions of mobile operating systems exist. We have tested the demo account on the OANDA web platform. An outstanding feature is the ability to open orders with the volume specified in non-standard lots - absolute units. You can open an order, for example, to buy 37 euros in the EUR / USD currency pair. The OANDA terminal is noticeably different from the MetaTrader and takes some time to master.

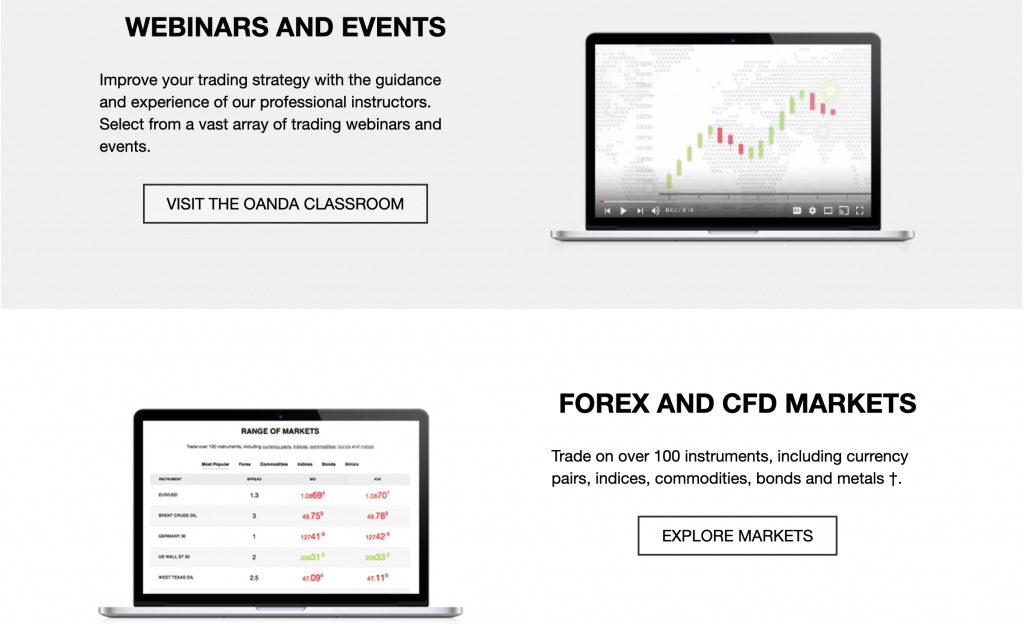

Education & Research

Both written and video files are available. In addition, the local experts conduct seminars to educate clients of different proficiency levels. The web course consists of 10 chapters on finance and investments. It covers tech and fundamental analysis aspects. Every topic is accompanied by a related video. Choose Getting Started if you are new to the business or the platform.

Pro traders can move right to the section with market news to stay on the wave. Forex traders would benefit from learning more about the recent trends established by Reuters, MarketPulse, MarketWatch, Mainichi, and CNBC. The site even offers an economic calendar forecast from 4CAST, and access to AutoChartist.

Safety and Security

All OANDA brand companies are regulated and non-trading risks are minimized. Customer funds are insured, and the amount of insurance payments depends on the jurisdiction of the company to which the account belongs to.

Client Care and Support

The customers can contact the support service via online chat, by phone (you can order a call back), or via email. Technical support works around the clock, five days per week. The operators of the online chat answer quite quickly (within a minute or two). They are available in English.

Verdict

First of all, the company will be of interest to serious traders who operate large amounts of money and want to minimize various force majeure events. For beginners with limited budgets, in our opinion, it makes no sense to go through the difficult registration process and deal with expensive international bank transfers. OANDA does not provide the no deposit bonuses loved by novice traders and primarily focuses on clients who trade with real money of their own. It mostly suits those who wish to connect via API or use auto-trading systems on MT4. The powerful regulatory track record is one of the solid reasons to pick this broker out of many others.

Comments 0