Top recommendation

Microsoft Corp

Abbvie Inc.

Credit Agricole SA

Apple Inc

Google Inc

Facebook Inc

Apple Inc

Google (Alphabet Class C)

AstraZeneca

Scams

More detailsHow to Choose the Right Crypto Exchange

Welcome to the website dedicated to tracking, searching, and reviewing brokers, crypto wallets, and crypto exchanges. Our main goal is to protect the users from low-quality services and the possibility of losing their money. We also want to help you choose the right platform for trading cryptocurrencies, as well as tokens to invest in as we have field experts with 12+ experience on board. Our team carefully analyzes the available brokerages and exchanges, trying to find platforms that offer the best trading conditions, such as:

-

Security measures

-

Privacy

-

Low fees

-

User-friendly interface

-

Simple navigation

-

Variety of banking options

-

Range of crypto pairs

-

Free education and training

-

Advanced content for professionals

-

Accurate stats and analytics

What is Forex (FX)?

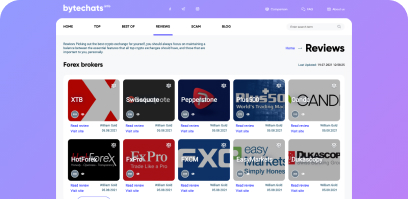

Well, we can help you make the decision based on our analysis and reviews. Our team evaluates both new and old Forex brokers.

Exchange Monitoring

If you’re looking for favorable exchange rates, view the full list of broker and exchange websites for a particular direction by selecting the currency pair you are interested in.

Why Choose ByTechats

So, we represent a top crypto comparison service. You may find our analogies on the web, but here is why most people, from dummies to experts, choose us.

Pages with detailed reviews

We collect all the necessary data to highlight various crypto wallets, brokers, and exchanges. From the registration procedure to bonuses and banking options - we have it all for you.

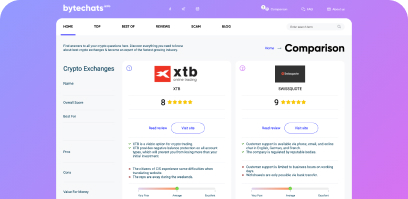

Objective comparisons

As we are not partners of any exchange or brokerage, we guarantee 100% objective comparisons on our site. ByTechats compares and contrasts prices, fees, and other rates every month to update data regularly.

Tips & tricks for users

No matter whether you’re an experienced user or a freshman in the crypto college, you may rely on our information and educational materials that will provide you with an in-depth overview of the digital currency world.

Should You Buy Cryptocurrency Today?

What is Bitcoin? Digital currencies, or cryptocurrencies, are electronic currencies that are generated by networks of computers and are used in place of traditional currencies. Paying with digital currency is not the same as paying with a credit or debit card, PayPal, or ApplePay - all of these payment systems refer to traditional currencies such as US dollars, British pounds, and Chinese yuan.

What is Ethereum? It’s one of 4,000+ digital currencies that oppose Bitcoin. It is one of the most promising crypto currencies as well. In case of a Bitcoin crash, Ethereum or Litecoin are some great options to consider.

Many traders and investors wish to find out how to buy Bitcoin. Let’s first discuss whether this game is worth playing. For more information, check the advantages and disadvantages of buying crypto.

Pros of Cryptocurrencies

As far as Bitcoin is the leader in the crypto world, we will list the benefits of cryptocurrencies based on this token.

✅Decentralization

One of the fundamental features of cryptocurrencies is decentralization. In January 2018, a record number of nodes, computers connected to the blockchain network, was recorded; it achieved $200 thousand. Since then, the value has been decreasing. It means that fewer users participate in the validation of transactions and store copies of the first cryptocurrency blockchain on their devices.

Bitcoin is not controlled by a private company or the government of a large state.

✅Cheap Transfers around the World

The transaction fee in the Bitcoin network and the speed of their execution do not depend on the distance over which the transfer needs to be made. Thanks to the rapid bitcoin evolution, the token will cope with this task on average in an hour. The fee will be incommensurate with the amount sent.

✅Uninterrupted Network Operation

The main danger for any cryptocurrency is a 51% attack; a group of miners controls at least 51% of the network, due to which it can influence transactions and the blockchain as a whole.

Mining companies will not destroy their source of income. Even if someone decides to attack the network, this will not destroy it. The cryptocurrency network has been operating error-free for years.

✅Deflationary Nature

Unlike, for example, the US dollar, which is issued on an unlimited scale, Bitcoin is not subject to inflation. Over time, the supply of cryptocurrency on the market will decrease, which means that even if demand persists, its price will rise. That is how one may boost Bitcoin profit.

✅An Easy Way to Invest and Make Money

In order to start trading Bitcoin, you do not need to have special licenses or knowledge. It is enough to go through the registration procedure on a crypto exchange or download an electronic wallet.

✅Protective Asset

During local economic crises, the crypto rate often rises above the market average. When people lose confidence in their national currencies, they try to find alternatives to save their money. Bitcoin, despite insane volatility, is not subject to inflation and, moreover, hyperinflation.

Pitfalls of Cryptocurrencies

Now, there are always two sides to the coin. Have a look at the list of drawbacks.

⛔ Volatility

Bitcoin is often referred to as a defensive asset. However, it is difficult to be sure that cryptocurrency savings will retain their value. The price of BTC at any moment can sharply collapse by more than twice. That is because of the Bitcoin revolution.

⛔ High Withdrawal Fees

One of the advantages of Bitcoin is the ability to transfer large amounts for low fees. This applies to transactions within the system. If an investor wants to cash out, they will have to pay a fee for the withdrawal of assets to exchanges or exchangers. They can lose from 2-5% or even more.

⛔ Regulators

Some analysts predict multiple rises in the price of Bitcoin in the future. Such a contribution in the future may turn out to be illegal if the government prohibits the ownership of cryptocurrency. In this case, the user risks losing all or part of the capital.

⛔ Criminals

Bitcoin is used not only for investment or cheap transfers. A user can purchase prohibited substances or launder criminal proceeds.

The funds may be frozen if you buy crypto illegally. It can be avoided by checking transactions using special services.

⛔ Difficulty in Usage

Bitcoin is a decentralized system that does not have a single governing body. Because of this, BTC holders are not immune to mistakes. For example, if an investor forgets the password for a digital wallet, it will not be possible to return the cryptocurrency.

Forex: Benefits and Drawbacks

Now, we’re moving to the next point, which is where to purchase cryptocurrencies.

What is Forex trading? Forex is the only market that really works around the clock and at any time with good liquidity. For busy traders, this is the optimal solution. Large currency centers are scattered all over the world, active in different time zones. For instance, as soon as the US market closes, trading begins in Asia.

The question is whether it makes sense to become Forex brokers. Check out the pros and cons below.

Pros of Forex:

✅ High profitability of trading.

The level of risk in Forex is ten times less than when gambling. Unlike gambling, everything here depends only on you as you can adjust the level of losses by closing the deal.

✅ Free working hours.

You trade on your own when you want. Earn $1000 per day, and then take a week off. Trading is available at any time of the day.

✅ Trading places.

The work is not tied to a specific place. There is an opportunity to trade at home or in Hawaii. Due to the fact that mobile platforms have appeared to open transactions, you do not even need to have a computer or laptop with you; a smartphone is enough.

✅ No need to be tech-savvy.

You can learn everything on your own, there is a lot of tutorials on the network. Free training is available at most brokerage firms.

Sure thing, you should not underestimate certain pitfalls. Have a look at them.

Cons of Forex:

⛔ High level of risk.

Making a profit does not always depend on you exclusively. You can lose your money even in the event of a computer malfunction, order failure, or freezing of the trading terminal.

⛔ Experience.

According to statistics, more than half of novice traders drain their first deposit in one day. Therefore, in order to successfully trade in the foreign exchange market, you will need some time to study.

Even if you manage to find the best Forex trading platform, the risks are still not excluded. You should trade smartly. The first step is studying the basics and reading reviews on different exchange services to choose the best one. That is where our professional platform steps in!

FAQ

-BTC

-ETH

-XRP

-USDT

-EOS

-LTC

-BCH

-LINK

-Binance Coin

-Libra"

- Cryptocurrency exchanges (Coinbase, GDAX). Choosing an exchange service should be as careful as choosing an online wallet. Check security, read reviews and feedback from other people who trade crypto.

- Cryptocurrency trading platforms. On these sites, sellers can find buyers, and vice versa. After the initial “meeting” at the site, users decide for themselves how they will transfer funds to each other. Usually they meet in person or use bank transfers.

- Cryptocurrency cards (Robinhood, Wirex). Special bank cards for direct payment or withdrawing money from an ATM.

- Transaction speed, convenience, and bonuses.

- The quality of customer service.

- Ease of usage/simple interface.

- The minimum deposit and additional fees.